Payments are evolving—and fast. If your business deals with international suppliers, remote staff, or cross-border clients, it’s time to explore how stablecoins like USDT, USDC, and even AUDD can simplify how you send and receive money.

At iTrain & Consult, our expert trainer, Pras, helps businesses understand how digital assets are changing the game. “Whether you’re a growing business or an established enterprise, adopting stablecoin payments via a corporate wallet could make your operations leaner, faster, and more cost-effective”, says Pras. Pras highlights that “unlike traditional cryptocurrencies, stablecoins are pegged to real-world assets (like the US dollar), making them stable, secure, and incredibly efficient”.

Pras manages digital asset portfolios for family offices and institutional clients, with a focus on insured custody, crypto payments, and liquidity solutions.

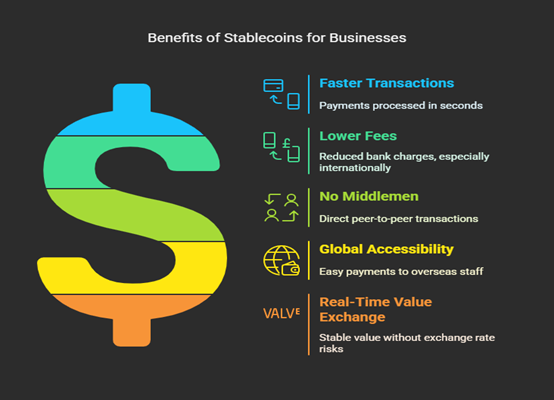

Why switch to stablecoins?

- Faster Transactions – Payments are processed within seconds, ideal for urgent or time-sensitive transfers.

- Lower Fees – Skip the hefty bank charges, especially on international payments.

- No Middlemen – Direct peer-to-peer transactions mean no delays or extra admin.

- Global Accessibility – Corporate wallets make it easy to pay overseas staff or suppliers—even in countries with limited banking infrastructure.

- Real-Time Value Exchange – No more holding your breath watching exchange rates swing— stablecoins remove that risk.

Ready to future-proof your payment systems? Our training and consultancy services can show you how.

iTrain and Consult does not provide accounting, financial, or tax advice and assistance. The contents of this publication are for general knowledge and information only.